On 26th November, the long-discussed Budget dropped and delivered something very different for SMEs and business to what we’ve known for the past 14 – 15 years. After years of public sector cuts, the UK Government have introduced a recalibration exercise.

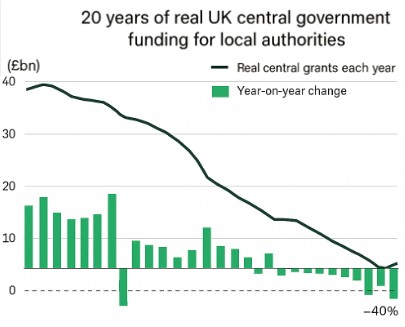

Since 2010, Hackney Council had lost 40% of it’s core spending power. They are facing a £36m shortfall just this year. The Mayor, Caroline Woodley, welcomed the Budget and praised the government for being one that is willing to “invest, reform and work with, not against councils.”

Caroline Woodley, Mayor of Hackney. Taken from news.hackney.gov.uk

Source: DLUHC; mhig revenue outturn (grants), ONS CPIH, adjusted to constant Dec (AI used to create this chart) Alt: A line graph plotting a gradual decline in Council funding in real terms over 20 years, dropping £40bn until a small uptick as of the 2025 budget.

What Money Has Been Promised To Fill The Void?

Councils will keep any receipts from Right to Buy sales in order to create new housing and a whopping £1bn will be provided for SEND (Special Educational Needs and Disabilities). The Household Support Fund for vulnerable families has a one year extension.

And Where Will The Money Come From?

A significant increase in employer and investor taxes. The government has effectively transferred much of the cost of social welfare to business owners. This includes increased wages, increased National Insurance contributions, and increased business rates.

In summary, the Chancellor announced changes that will impact your SME … and soon. In fact, it’s time to give serious consideration to your staffing levels, your business property, your pension arrangements and, if you’re an investor, your exit strategy.

Reason for Concern?

There was an overwhelmingly negative response from the business community. Huge concerns were raised that the overall effect will be to put businesses off from investing in their growth and people and, worse, that many businesses would simply not survive.

The Institute of Directors (IoD) did a snap poll of over 500 business leaders. The results? 80% reported feeling negative about the Budget. That’s a 13% increase on last year. The Institute concluded there were ‘worrying implications for the economy’s future growth trajectory’.

A “tough Budget for business to swallow” Shevaun Haviland, BCC

If you own a small coffee shop in Shoreditch or a design agency in Dalston with, say, 5 – 10 staff, things are about to get tight.

The most scathing response I have read was from the London Chambers of Commerce and Industry (LCCI), who include the London Borough of Hackney in their borders. They said that London businesses were “losing faith in the Government’s economic growth strategy … [that the Budget had] not gone far enough to protect London businesses which are the engine room of nationwide growth.” … [and that] “the only certainty they received was higher costs.”

An Alternative View

Is the loss of struggling businesses a necessary step to righting a stale economy? Unproductive businesses will go fallow, leaving space for those with higher margins to expand. Zombie companies, named because they aren’t able to make enough money to invest in any growth, will finally meet their end.

There’s also concern not enough money is being re-channelled to public services. Hackney Councillor Claudia Turbet-Delof implied the needle has not swung far enough. She warned that Hackney Borough will face a “complete exhaustion of reserves’ within 18 months”. The Local Government Association (LGA) agreed and said the Budget failed to provide the increases in council funding that they “desperately need.”

The Big Squeeze: Running A Profitable Business Just Got Harder

Increases to National Insurance

The Employment Allowance, or the threshold your total staff wage bill needs to hit before you have to pay Class 1 NIs for them, has gone up from £5,000 to £10,500. The previous cap on claims of £100K is no more.

At the same time, your liability per employee has dropped from £9,100 to £5,000. The rate of NI Class 1 contributions will also rise to 15% next year. This means paying 1.2% more tax on an additional £4,100 of earnings per employee, regardless of what profits you make. Also, this £5,000 threshold has been frozen until 2031, which means that as wages rise each year, the effective threshold will get lower and lower. Experts call it ‘fiscal drag’.

Takeaway #1: Even if you have only 4 full-time employees, it’s likely you will be paying more NI than you were before. SMEs, especially in the hospitality and service sectors, are going to need to think carefully before their next hire. Ensure your payroll software is updated to claim this automatically from Month 1 of the new tax year.

Consider the following example:

The Sweet Spot: An imaginary independent bakery in Hackney.

- Staff: 1 Manager, 1 Head Baker, 3 Floor Staff (mix of full/part-time).

The business faces a drastic increase in underlying NI costs due to the rate rise (13.8% → 15%) and threshold drop (£9.1k → £5k).

| Role | Salary | Old Employer NI | New Employer NI |

| Manager | £38,000 | £3,988 | £4,950 |

| Head Baker | £32,000 | £3,160 | £4,050 |

| Barista 1 | £24,000 | £2,056 | £2,850 |

| Barista 2 | £24,000 | £2,056 | £2,850 |

| PT Server | £12,000 | £400 | £1,050 |

| TOTAL | £11,660 | £15,750 | |

| Allowance | (£5,000) | (£10,500) | |

| FINAL | £6,660 | £5,250 |

Despite the increases, this business actually pays £1,410 LESS in National Insurance than before because the allowance increase (£5,500 extra relief) outweighs their NI cost increase (£4,090 extra cost).

Increases to National Minimum Wage

For SMEs, the costs of training for any apprentices under 25 will be fully funded and the 5% employer contribution removed. This will help with developing younger staff in-house while managing the rising cost of employment.

At the same time, minimum wage rates will rise from April 2026:

- Over 21s (National Living Wage): Rises to £12.71 per hour.

- 18 to 20-year-olds: Rises to £10.85 per hour.

- Under 18s and Apprentices: Rises to £8.00 per hour.

Takeaway #2: If you employ anyone at NMW rates, your wage bill Is about to increase across the board and not by a small margin.

Increases to Business Rates

Business rates are essentially the “council tax” for commercial properties, paid by businesses on the shops, offices, and warehouses they use.

From April 2026, The Chancellor announced a 40% relief for retail, hospitality, and leisure (RHL) properties. However, previously, the relief was 75%. This is an effective increase. Of course, businesses in other sectors or with larger, more expensive properties valued over £500,00 will be paying higher rates to pay off the shortfall.

Takeaway #3: The is a relief cut, not an additional benefit. The government wants high street businesses to pay less than their larger out of town counterparts. The £500, 000 business property threshold will disproportionately effect parts of the country where property is valued more highly. This is all in addition to Hackney’s increasingly higher rents as higher wage earners spread out from Central London.

Karim Fatehi, CEO, LCCI. Taken from londonchamber.co.uk Quote from Autumn 2024 Budget | News and Insights – LCCI

“We are deeply concerned… the combined package of increased employer National Insurance Contributions, cuts to business rates relief, and minimum wage increases will create a challenging environment… and curtail their ability to invest or hire new people”.

Summary of Effects on SMEs

| Policy | Details of Change | Effective |

| Employer National Insurance (NICs) | Rate increased from 13.8% to 15%. Secondary threshold (earnings point for contributions) lowered from £9,500/£9,100 to £5,000. | April 2025 |

| National Living Wage (NLW) | Rises to £12.21/hour (April 2025) and then to £12.71/hour. | April 2026 |

| National Minimum Wage (NMW) | For 18-20 year olds, rises to £10/hour (April 2025) and then £10.85/hour. | April 2026 |

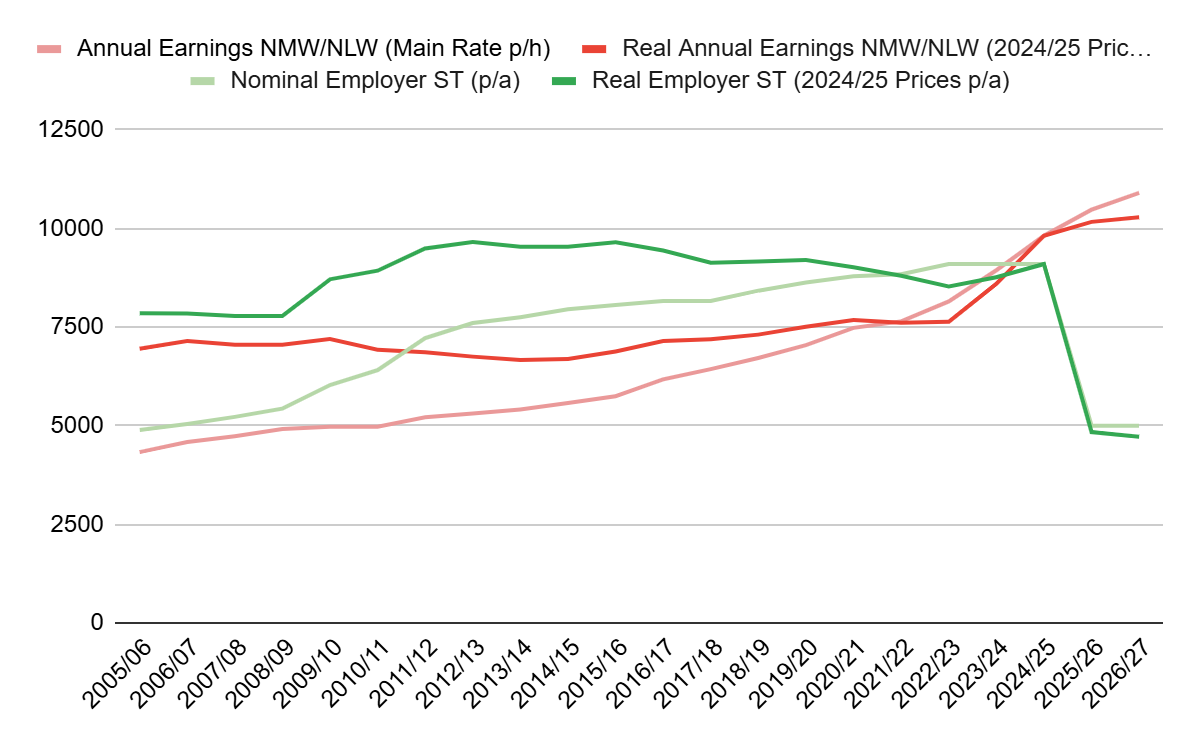

20 years of change in National Minimum Wages and Employer NI Thresholds

Chart created manually (NMW based on a 16.5 hr working week).

The Big Squeeze: Earning From Your Business Just Got Harder

The Squeeze on Dividends

Many small business owners pay themselves a combination of a small salary and dividends (a share of the company’s profits). Owners who pay themselves a low wage but a high dividend will find, from April next year, that this approach will pay less than before.

From April 2026, the tax rates on dividend income will rise by 2% (from 8.75% to 10.75%; higher rate from 33.75% to 35.75%).

Jason Hollands, managing director at Evelyn Partners: “These hikes seem to be aimed mainly at extracting more cash from the UK’s small business owners, who don’t have the option of owning their company shares in a tax efficient individual savings account.”

Annual Investment Allowances (AIA)

The AIA allows you to deduct the full value of qualifying items from your profits before tax. Instead of steady depreciation being built into your accounts to cover the value, you get 100% tax relief in the year you buy it, limited to a cap of £1M. This change begins with immediate effect which means, if you are profitable this year, make sure your equipment purchases are invoiced and delivered (and clearly dated) before your company’s financial year-end.

The Sweet Spot, our imaginary Hackney bakery.

The owners could invest in equipment such as:

- Kitchen Equipment: Ovens, fridges, coffee machines, dishwashers.

- Fittings: Air conditioning, heating systems, extraction fans, bathroom fittings (these are “Integral Features”). Consider fixtures like new bars or shelving.

- Tech: EPOS systems, computers, sound systems.

Let’s say the bakery makes a gross profit of £60,000. They decide to invest in a new deck oven and air conditioning before their year-end.

- Purchase: New Deck Oven (£12,000) + AC Installation (£8,000) = £20,000 Total.

| Scenario | Gross Profit | Taxable Deductions (AIA) | Taxable Profit | Corp Tax (est. 19-25%) |

| Without Investment | £60,000 | £0 | £60,000 | ~£11,400 – £15,000 |

| With AIA Claim | £60,000 | (£20,000) | £40,000 | ~£7,600 – £10,000 |

By using the AIA, the business saves roughly £3,800 – £5,000 in Corporation Tax immediately.

The Squeeze on CGT

First, note that if this is your first year paying CGT, there is a 40% relief available from January 2026 (with the other 60% eligible for writing down allowances from Year 2 onwards).

For all other businesses, the main rates have increased from 10% and 20%, with the higher rate rising from 18% to 24%. While the main rate is capped at 25%, the “write down allowance” main rate was reduced, meaning businesses will now receive less tax relief on investments in equipment.

The Squeeze on Asset Disposal

Business Asset Disposal Relief rate will increase from 10% to 14% (April 2026) and then to 18% (April 2027). This means that selling after April 2026 could cost substantially more. Although the standard CGT rate for higher-rate taxpayers is 24%, the difference is shrinking between the two.

Hackney CADS: An imaginary design agency in Hackney.

Hackney CADS plans an exit with a £2.5 million gain in value.

| Year of Sale | BADR Rate | £2.5m Gain Tax | Net Proceeds |

| Pre Apr 2026 | 10% | £250,000 | £2,250,000 |

| Apr 26 – Apr 27 | 14% | £350,000 | £2,150,000 |

By 2027, the margin between taking advantage of BADR and paying main rate CGT will only be £150K, shrinking quickly from the current £350K.

Derry Crowley, CEO of Xeinadin. Taken from the Xeinadin.ie website. Quote from RedLeafAccountancy

“The reduction in the writing down allowance limits businesses looking to invest in equipment in order to remain competitive. Removing £1.5bn in relief at a time when firms are already managing tight margins could make long-term investment harder, not easier.”

Summary of Effects

| Policy Name | Policy Detail | Effective Date |

| Dividend Tax | Rates increasing by 2 percentage points. Basic rate rises to 10.75% (from 8.75%) and higher rate to 35.75% (from 33.75%). | April 2026 |

| Capital Gains Tax (Main Rates) | Main rates increased to 18% (from 10%) and 24% (from 20%). | Budget Day 2024 |

| Business Asset Disposal Relief | Rate increasing to 14% (from 10%) and subsequently to 18%. | April 2026 (14%) April 2027 (18%) |

| Inheritance Tax (Thresholds) | Nil-rate band frozen at £325,000. | Until April 2030 |

| Inheritance Tax (Pensions) | Inherited pension funds will be included in an individual’s estate for IHT purposes. | April 2027 |

| Inheritance Tax (Reliefs) | Reduction in reliefs for AIM shares, Business Property, and Agricultural Property. | 6 April 2026 |

| Corporation Tax (Allowances) | “Write down allowance” main rate reduced (from 18% to 14%), lowering tax relief on equipment investments. 1st year allowance of 40% relief | 6 April 2026 Jan 2026 |

Takeaway #4: The government is encouraging investors to stay put and build what they have, rather than flip and move on. Exiting is more expensive but rewards investing cash in hard assets. Owners, contractors that are winding down companies, and those planning management buyouts or family transfers will all be affected. Planned exits will be significantly if executed before April 6th next year.

In summary, the 2025 UK Autumn Budget recalibrates the costs of public services and shifts those costs to businesses through increased employer National Insurance, higher minimum wages, and reduced business rates relief (for retail and hospitality). SME will simultaneously be taxed more for business exits.

The Big Squeeze is on.

Leave a Reply